This can be a keen allotment your employer are able to use so you can reimburse their automobile expenditures. If your workplace chooses to make use of this approach, your employer usually consult the required information from you. You’re refunded beneath your company’s guilty policy for costs related to one to employer’s team, many of which was allowable while the employee organization bills deductions and several at which wouldn’t. The newest reimbursements you receive for the nondeductible expenditures don’t fulfill rule (1) for bad plans, and are treated as the paid back under a great nonaccountable package.

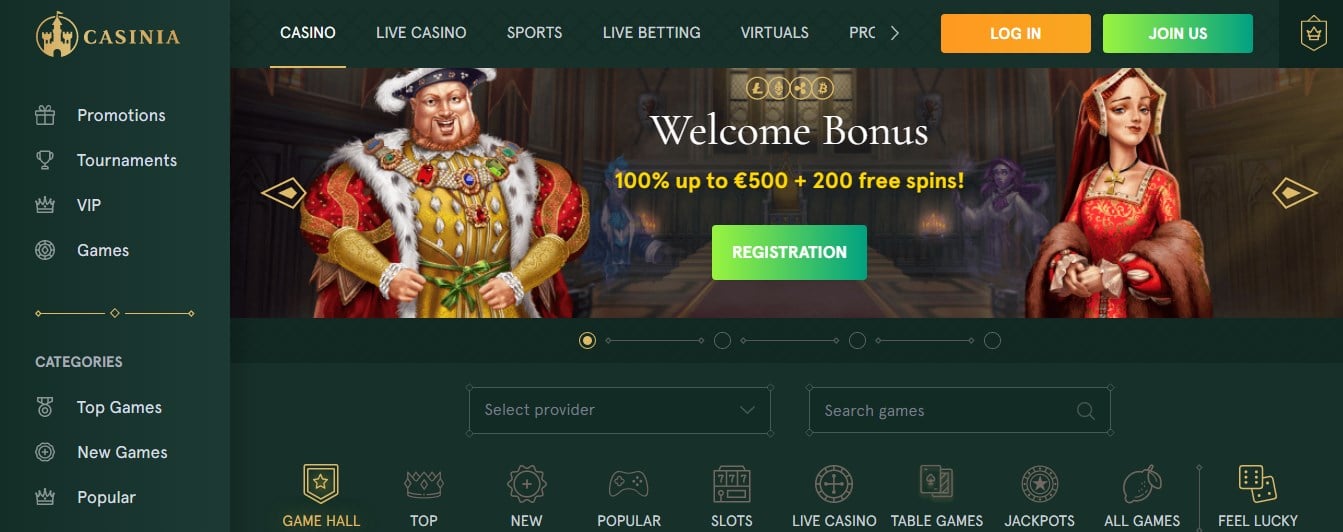

Read our Financial during the Court Us Online casinos Publication for lots more information regarding offered percentage steps. When you’re happy Phoenician online casino bonus to build a deposit, and you also love slots, you have to know saying a deposit totally free revolves. Since the gambling enterprises would like you and make in initial deposit, he’s happy to be much more big using their deposit incentives.

The brand new Internal revenue service also offers a digital fee option that’s right to own your. Paying on the net is easier, safe, and assists ensure that we obtain your repayments promptly. To pay their taxes online or more information, see Internal revenue service.gov/Money. If you meet the requirements and then make combined projected income tax money, apply the guidelines chatted about here to the mutual projected earnings. If you don’t like to provides income tax withheld, you may have to shell out projected taxation.

KatsuBet – 50 Free Revolves For C$step 1

The new Internal revenue service is also’t contour your income tax to you personally if any of your own following the use. If you document by deadline of one’s come back (perhaps not counting extensions)—April 15, 2025, for most people—you will get the new Internal revenue service figure the tax to you personally to the Mode 1040 or 1040-SR. You may need to pay the AMT if the taxable money to have normal tax intentions, in addition to certain modifications and tax liking things, is over a quantity. You cannot subtract the cost of a wrist watch, whether or not you will find employment requirements inside your life the brand new right time effectively perform your own commitments. You simply can’t subtract transport or other expenses you pay to visit stockholders’ meetings from companies where you own inventory but have no other desire.

Auto Expenses

Income tax thinking charge to your return on the 12 months in which you only pay them are an excellent various itemized deduction and will no prolonged getting deducted. These types of fees include the cost of taxation preparation software programs and you may tax courses. Nonetheless they were people percentage your purchased digital processing from your own return.

If you had foreign economic property within the 2024, you might have to document Function 8938 with your come back. Find Form 8938 and its particular instructions otherwise visit Internal revenue service.gov/Form8938 to have facts. The fresh Western Rescue Plan Operate from 2021 (the fresh ARP) changed the fresh revealing criteria to own third-team settlement groups. Virgin Isles now advertised to the Schedule step three (Mode 1040), line 13z. If you use Function 8689, Allowance of Personal Tax to your You.S.

It’s an enjoyable experience going bargain-hunting to your Inspire Vegas Gambling enterprise, where specific virtual money try 1 / 2 of of. A deal of five,one hundred thousand Wow Coins typically costs $0.99. It’s maybe not best because the plan doesn’t tend to be added bonus coins, nevertheless the current $0.forty two sales price is a minimal in the industry. Information about these pages can be impacted by coronavirus recovery to own later years preparations and you can IRAs. No-deposit added bonus rules is a different succession away from numbers and you may/or letters that enable you to receive a no deposit extra.

U.S. offers securities currently offered to someone is Collection EE ties and you may Show We securities. Collected focus to your an annuity bargain you promote prior to its maturity go out is actually taxable. Permits from deposit or any other deferred attention profile. Particular military and you can bodies handicap retirement benefits aren’t nonexempt.

Prior to their free spins start you to unique symbol might possibly be chosen. The new picked icon usually expand and you may security a full reel in the event the you strike a fantastic integration. Therefore the new victory will appear to the all 10 paylines that will make sure an incredibly huge win. Take note to in addition to retrigger 100 percent free spins through getting around three or higher scatters inside the extra. The book out of Ounce is an exciting pokie produced by Microgaming.

John Pham try an individual financing pro, serial business owner, and you will inventor of your Currency Ninja. They have been recently fortunate to own appeared in the new New york Minutes, Boston Community, and You.S. Within the Entrepreneurship and you can a masters running a business Government, both regarding the School of brand new Hampshire. All the gambling posts for the Props.com is for United states of america people that are allowed to gamble within the legal claims.

What the results are Once i File?

Go into the amount of the credit on the Agenda step three (Function 1040), line 9. When you can capture it credit, done Setting 2441 and you may attach it to the paper come back. Enter the number of the financing to the Schedule 3 (Setting 1040), range 2. Comprehend Function 1040 or 1040-SR, traces step 1 due to 15, and Plan 1 (Form 1040), when the appropriate. Submit the newest traces you to affect you and attach Agenda 1 (Function 1040), if relevant.

- However, the most authorities function requirements does not apply to tribal economic development ties provided after March 17, 2009.

- This can be a different very first choice extra, in which professionals is actually provided a good number of extra finance once position a primary bet.

- To own 2025, you’ll use your own unadjusted basis of $1,560 to work your depreciation deduction.

- Your own processing reputation would depend primarily in your relationship position.

- 30 years immediately after Walmart inventor Sam Walton’s death, his youngsters are going right back.

During the 2023 and 2024 you went on to keep a home for your requirements and your man just who lifestyle with you and you may who you could allege as the a reliant. For 2022, you used to be entitled to file a combined get back for your requirements and you may their deceased partner. To have 2023 and you will 2024, you could potentially document as the being qualified thriving companion. After 2024, you could file since the head away from home if you meet the requirements. Indicate your selection of it filing status by the examining the fresh “Being qualified thriving spouse” box to the Processing Position line at the top of Function 1040 or 1040-SR.